2025 Federal Income Tax Brackets

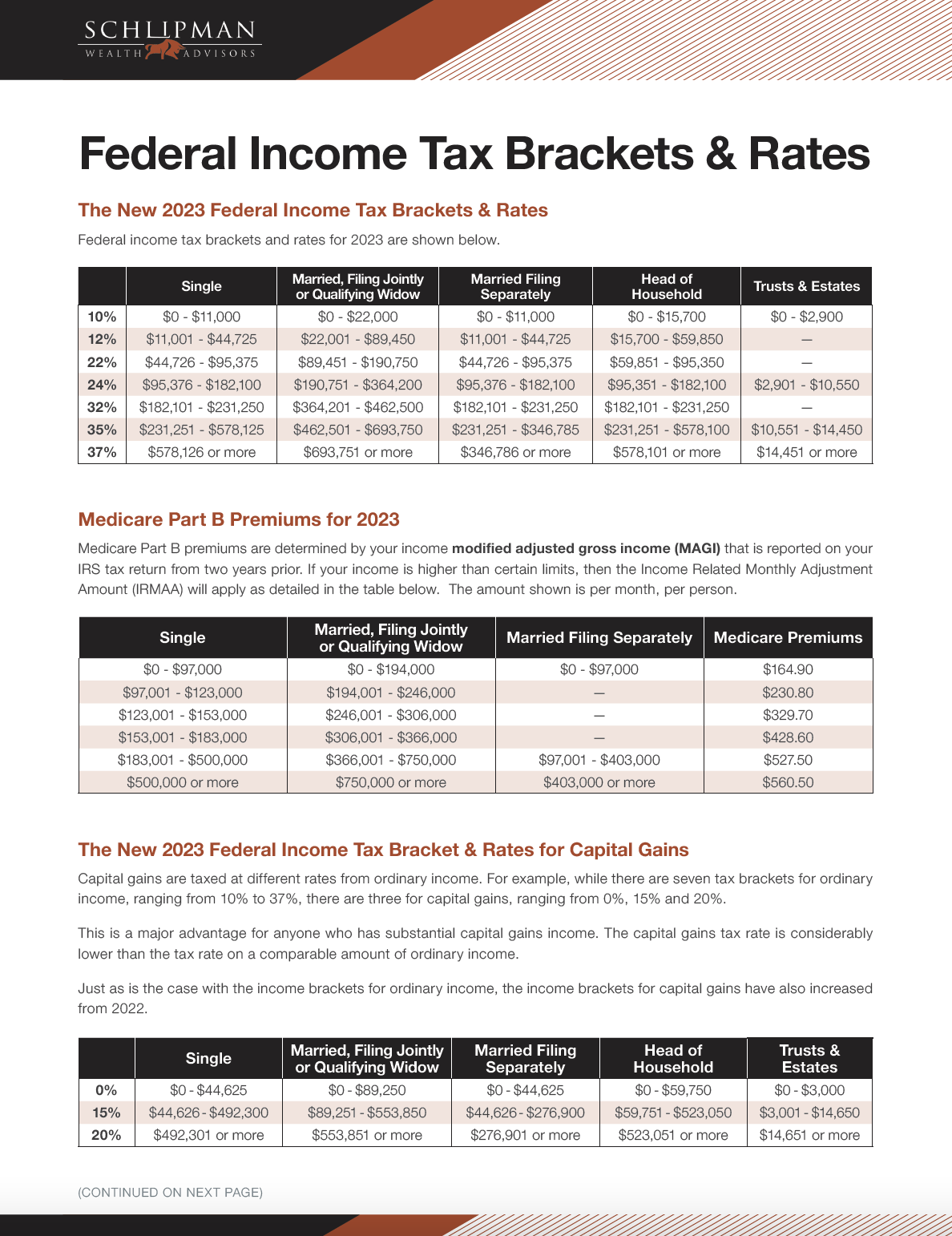

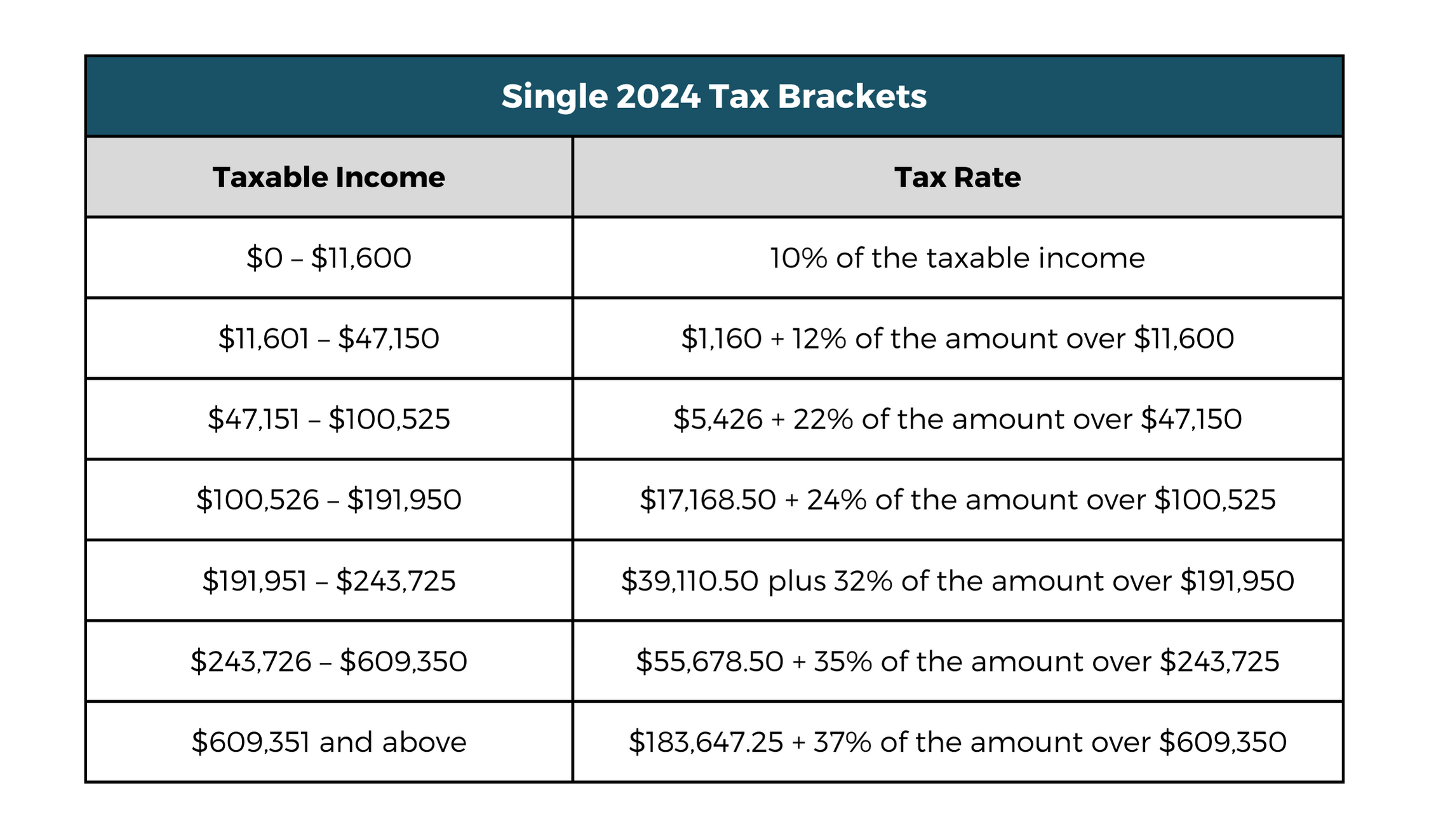

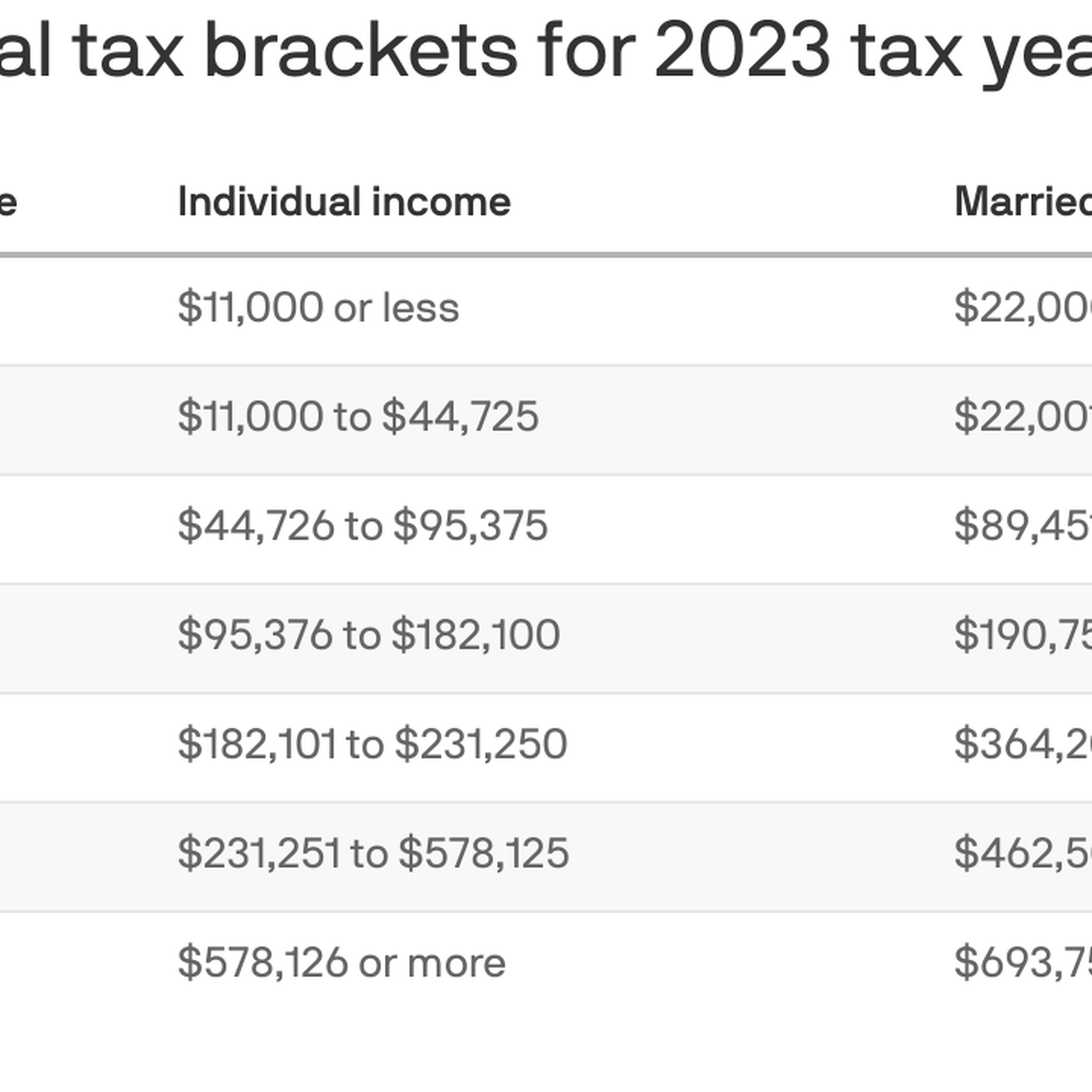

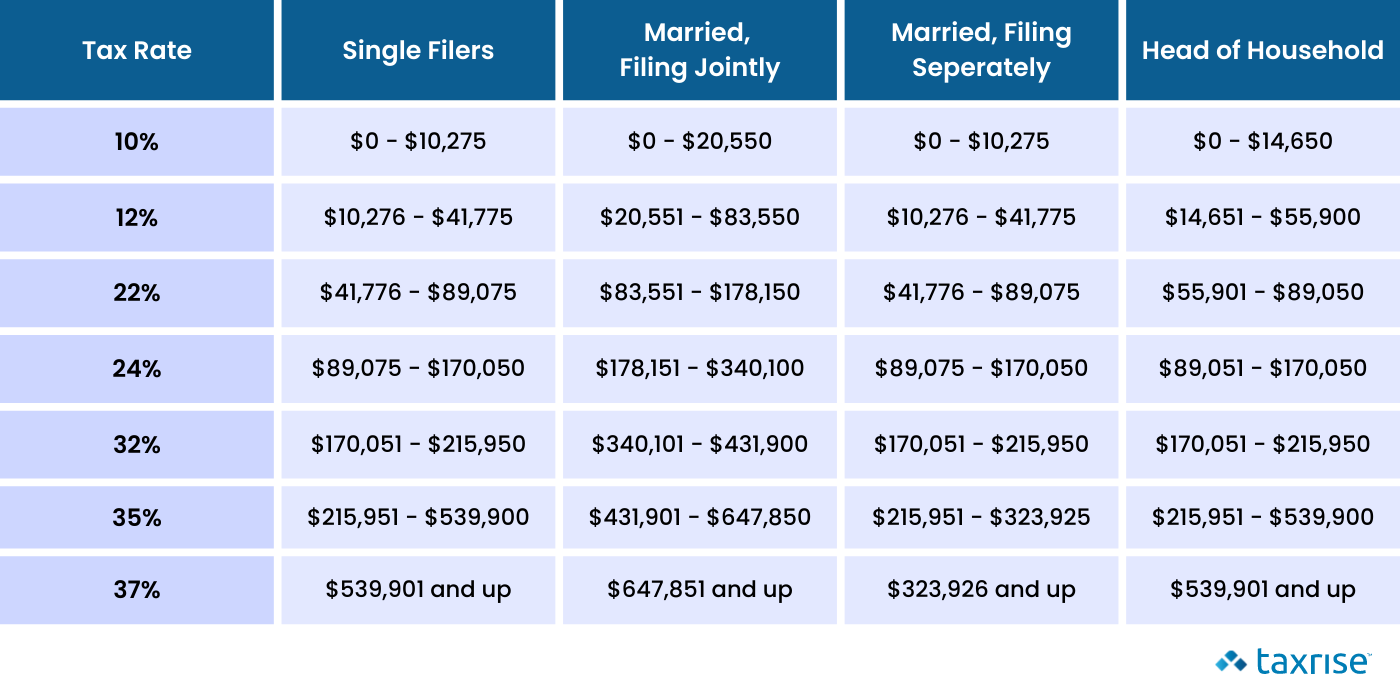

2025 Federal Income Tax Brackets. For 2025 are the same as the rates for 2025—10%, 12%, 22%,. 10%, 12%, 22%, 24%, 32%, 35%, and 37%.

For calendar years 2018 through 2025, taxable ordinary income earned by most individuals is subject to the following seven statutory rates: Simply enter your taxable income and filing status to find your top tax rate.

T200018 Baseline Distribution of and Federal Taxes, All Tax, 10%, 12%, 22%, 24%, 32%, 35%, and 37%. There are seven different income tax rates:

Federal Tax Brackets Educational Walkthrough and Visualization, You pay tax as a percentage of your income in layers called tax brackets. 2025 tax brackets (for taxes filed in 2025) the tax inflation adjustments for 2025 rose by 5.4%.

Federal Tax Brackets & Rates — Schlipman Wealth Advisors, 2025 tax brackets (taxes due in april 2025) the 2025 tax year, and the return due in 2025, will continue with these seven federal tax brackets: S, standard deductionthe standard deduction reduces a.

Va Tax Brackets 2025 Ashly Leontine, The federal corporate income tax system is flat. In 2025 and 2025, there are seven federal income tax rates and brackets:

Tax Rates 2025 2025 Image to u, Tax year 2025 tax rates and brackets. The first $11,000 of income will be taxed at 10%.

Federal Withholding Tax Tables Review Home Decor, The tcja created new, lower tax rates and increased the income thresholds before each new marginal tax bracket applied. For calendar years 2018 through 2025, taxable ordinary income earned by most individuals is subject to the following seven statutory rates:

Shifting Retirement Assets From TaxDeferred To TaxNow By 2026, The figure below shows that the upper income. However, you can use them in advance to plan out any personal finance moves to lower the tax bill you’ll pay in 2025.

How Rising Inflation Can Affect Your Federal Tax Bracket Next Year, As your income goes up, the tax rate on the next layer of income is higher. How do you reduce the amount of taxes you owe?

Federal Tax Earnings Brackets For 2025 And 2025 Modernlifestyle360, 10%, 12%, 22%, 24%, 32%, 35% and. Taxable income and filing status determine which federal tax rates.

IRS adjusts federal tax brackets every year, Calculate your income tax brackets and rates for 2025 here on efile.com. The next $33,725 will be taxed at 12%.

The tax cuts and jobs act (tcja) made many significant, but temporary, changes to the individual income tax code to lower tax rates, widen brackets, increase.