Monopolistic Workers Comp States 2025

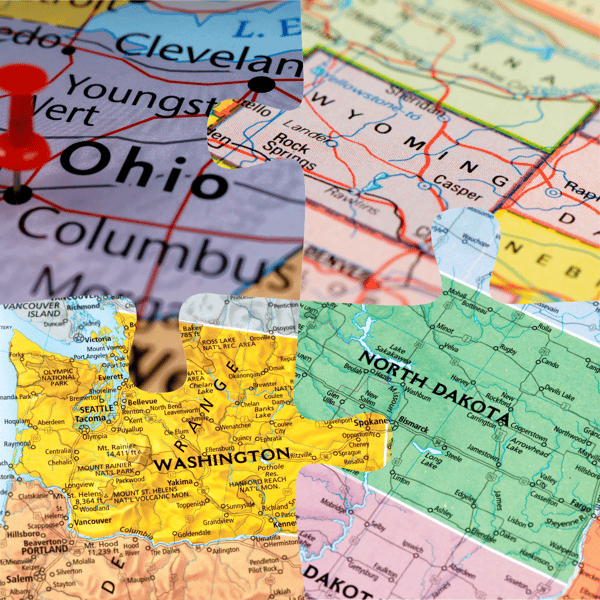

Monopolistic Workers Comp States 2025. North dakota, ohio, washington, and wyoming are monopolistic states for workers compensation. States with this type of program in.

Learn how this affects your business and ensure you’re covered. Monopolistic states are states that require worker’s compensation coverage to be provided exclusively by a state fund.

In most states, you have the option to compare quotes with private insurance carriers or a state workers’ comp fund.

Monopolistic States & Stop Gap Coverage What you need to know? Nixer, Instead, each jurisdiction has its own rules and regulations that govern the placement and administration of workers’ compensation insurance. Ohio, north dakota, washington, and wyoming.

Home Insurance, Brokerage & Consulting Denver TriMountain Corp, While both competitive and monopolistic states regulate workers’ compensation insurance to ensure coverage for injured workers, there are notable differences in how they. Ohio, north dakota, washington, and wyoming.

Workers Compensation Insurance Monopolistic States For Workers, Learn how this affects your business and ensure you're covered. If you’re a business owner within a monopolistic state, some restrictions may.

Monopolistic states workers compensation Everee, A monopolistic state fund requires businesses to purchase workers’ comp coverage through the state. The following states/jurisdictions are monopolistic fund states:

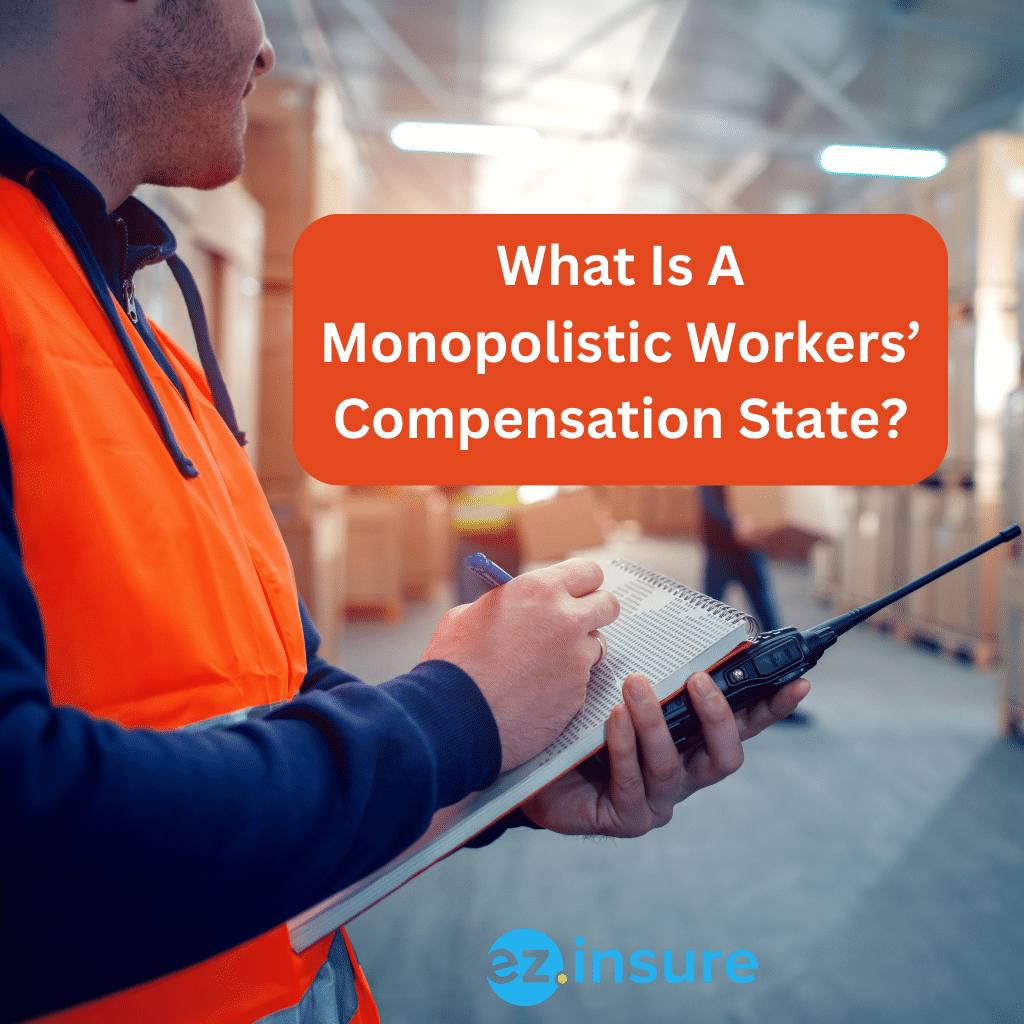

What Is A Monopolistic Workers’ Compensation State? EZ.Insure, The states that are monopolistic fund states for the most common insurance fund, workers’ compensation, are north dakota, ohio, washington, wyoming, puerto rico, and the u.s. States with this type of program in.

Which States Are Monopolistic for Workers' Compensation, Instead, each jurisdiction has its own rules and regulations that govern the placement and administration of workers’ compensation insurance. Ohio, north dakota, washington, and wyoming.

Guide to Monopolistic Workers’ Comp States Novatae, Businesses in a monopolistic state cannot obtain workers’ compensation from. Understand compliance and coverage requirements.

+Monopolistic+States+–.jpg)

Best Practice Strategies of a Workers’ Compensation Program ppt download, Monopolistic state programs have a certain amount of limitations for workers’ compensation insurance. North dakota, ohio, washington, and wyoming are monopolistic states for workers compensation.

Monopolistic Workers Comp States 2025 Dede Monica, Instead, each jurisdiction has its own rules and regulations that govern the placement and administration of workers’ compensation insurance. Monopolistic state programs have a certain amount of limitations for workers’ compensation insurance.

Guide to Monopolistic Workers’ Comp States Novatae, The states that are monopolistic fund states for the most common insurance fund, workers’ compensation, are north dakota, ohio, washington, wyoming, puerto rico, and the u.s. Instead, each jurisdiction has its own rules and regulations that govern the placement and administration of workers’ compensation insurance.

North dakota, ohio, wyoming, and washington are the four states with this specific requirement and are referred to as monopolistic states.

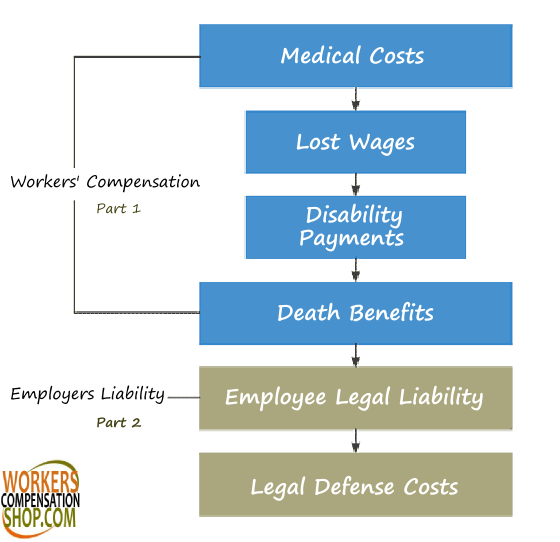

Monopolistic state programs have a certain amount of limitations for workers’ compensation insurance.